If you are an e-commerce website owner, pay later payment gateways may be your next best investment.

These solutions give customers the ability to pay for their purchase at a later date. This can be extremely beneficial because it gives buyers the opportunity to pay for what they want without having to worry about it now.

56% of customers want to see multiple payment options [No Cart Left Behind (columnfivemedia.com)] at checkout. Since cart abandonment is a key issue for ecommerce, keeping customers happy at the point of decision is a big deal.

Buy now, pay later is a brilliant option to make available to people while they are shopping, especially if your items are on the expensive side.

WooCommerce Pay Later solutions also lead to higher sales. Affirm, a pay later provider, estimates their retail partners see an average of 85% higher order values [In crisis, monthly payments can make a difference (affirm.com)] when they offer customers a pay later option.

Turns out, WooCommerce pay later payment options really help generate more revenue.

What are the Advantages of Buy Now, Pay Later Solution?

You have a great product or service to sell. You know it will increase your business, but you’re not sure how to get the money up-front from customers. You’ve heard of buy now, pay later solutions which allow consumers time to make their purchase decision and still pay for the item in full at a later date.

This is an excellent option for ecommerce store owners who are looking for ways to boost their sales volume without taking on more risk.

Here’s why a WooCommerce payment gateway that allows customers to set up a payment plan will work for your business.

Who Are the Buy Now, Pay Later Merchant Providers?

There are at least five major Woocommerce pay later providers you can offer to your shoppers on your checkout page. Each has advantages and disadvantages as well as different pricing options.

Here is a list of the major five providers with some information about each one to help you decide which one of these payment methods is best for your business and customers.

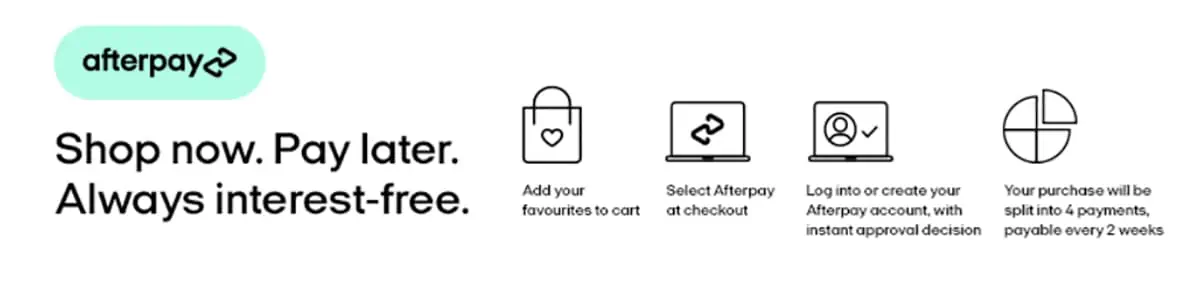

Afterpay is the WooCommerce plugin for offering payment plans to customers through Clearpay. Clearpay launched in 2015 and quickly grew to tens of thousands of business partners.

You can add the WooCommerce plugin to your site, set up a Clearpay account and be up and running very quickly. Customers will be able to make payments and will not be charged any interest if they pay on time.

How much does it cost?

They don’t advertise their fees, but the Woocommerce plugin is free. Business insiders estimate the fees to be 3-6% of the total sale amount.

PayPal is one of the biggest payment providers in the ecommerce world. Their Pay in 4 option is available for WooCommerce websites through a WooCommerce plugin.

Here are benefits of PayPal Pay in 4 for your business:

- Customers say they are 64% more likely to purchase when they see interest free payments available at checkout.

- Businesses offering payments spread over time saw a 56% increase in average order value.

How much does it cost?

PayPal fees are a flat 2.9% plus $0.30 per transaction. There is no charge for the WooCommerce plugin.

You can take advantage of the huge popularity of Amazon by connecting your WooCommerce website to Amazon Pay. The ELEX WooCommerce Amazon Pay plugin lets any customer connect their Amazon account to your WooCommerce store.

There are two key reasons to add Amazon Pay:

- Buyers are comfortable with Amazon payments and already trust their security. This builds confidence during the checkout process.

- You receive your payments faster and don’t have to deal with all the payment issues like chargebacks and expiring credit cards.

How much does it cost?

The WooCommerce plugin costs $59 per year. There is also a fee of 2.9% plus $0.30 per transaction.

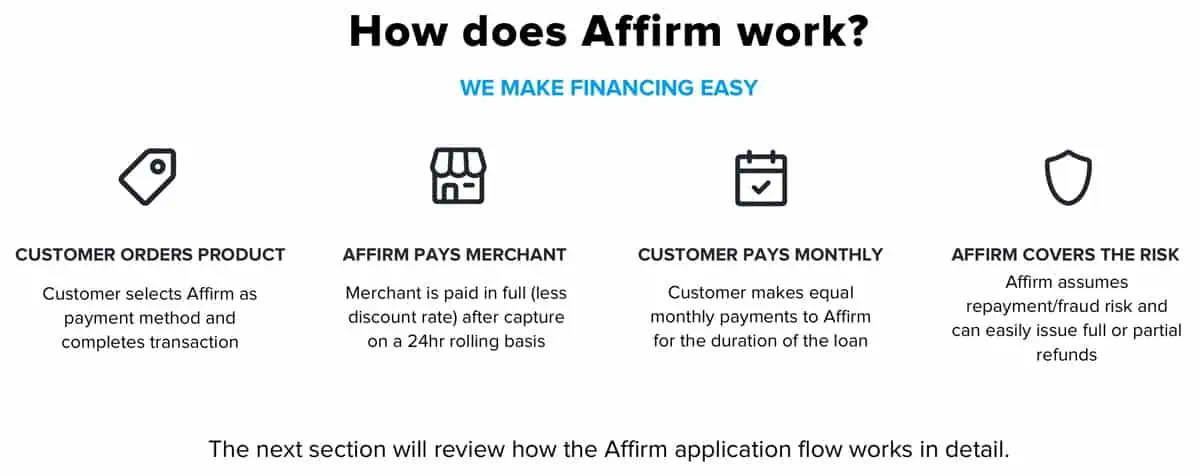

Affirm offers tailored monthly payment plans to allow users to buy what they love. Increased conversion rates happen because more shoppers are buying things and they often buy more than the typical customer. Affirm also has a great marketing team that works with over 6,000 U.S. merchants and over 5 million people in their network to help your business reach new potential customers.

Affirm’s own statistics claim they improve ecommerce businesses:

- 85% higher Average Order Value when shoppers use Affirm

- 20% repeat purchase rate with Affirm as an option

For your business, Affirm works similarly to the other BNPL solutions. Affirm sends you payment in full and then bills the customer for the duration of their agreed payment plan.

One of Affirm’s selling point is their higher approval rate. They approve 20% more customers than their competitors. This means more people buying your products!

How much does it cost?

Affirm typically charges 5.99% + $0.30 per transaction. This might vary a little by industry. There are no other charges for using the service.

Make your checkout flow easier for customers with a Klarna hosted widget which offers payment options.

Klarna is Europe’s largest bank and offers payment solutions for 90 million consumers. They offer a variety of payment options including direct payments, pay-after delivery, and installment plans that let you pay when and how you prefer to online.

The payment options available to your customers are:

- Buy Now, Pay Later – Payment in full deferred by 14-30 days.

- Buy Now, Pay Later in Instalments – payment made over a number of months

- Slice It – pay later in long-term monthly payments

- Pay Now – direct payments for all items

How much does it cost?

Klarna’s normal payment fees range from 3.29% – 5.99% plus $0.30 for each transaction. Some of their specific products, such as Instant Shopping, also have a $30 monthly fee.

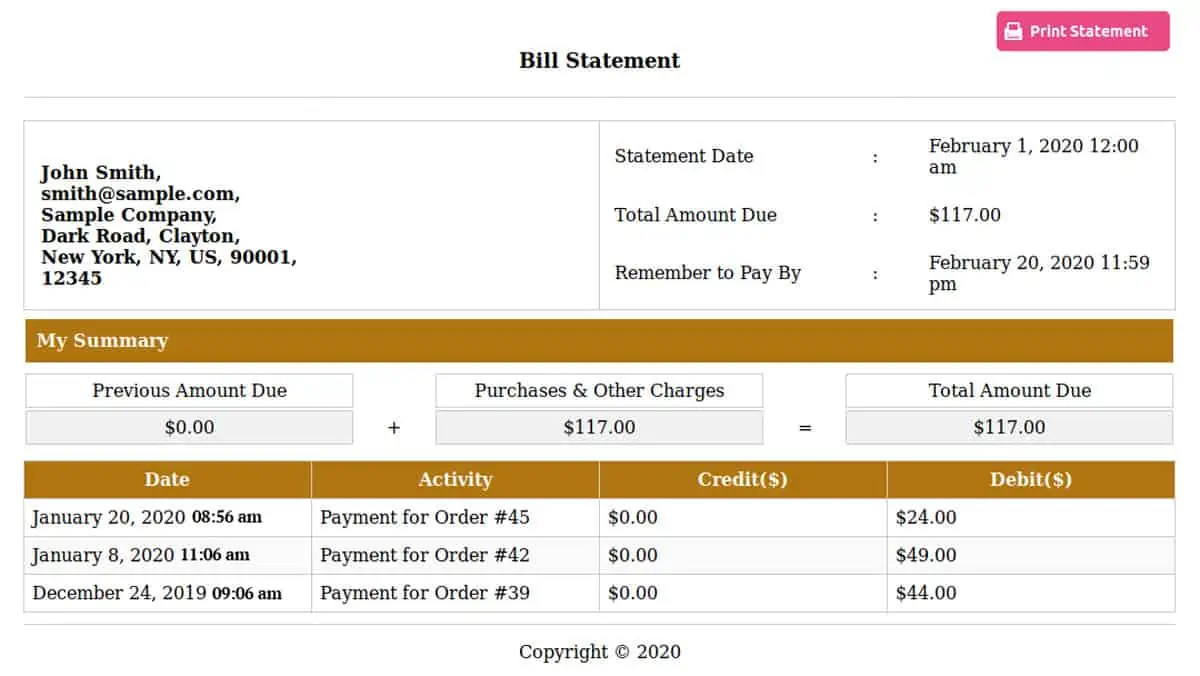

Credit Line differs from the other buy now, pay later solutions because it works like a traditional line of credit.

Here’s a quick overview:

- Customer applies for a line of credit

- If approved, the customer receives a monthly billing date and payment date.

- They can shop on your website and purchase things with the credits they have been approved to use.

- On their billing date, Credit Line will generate a bill and send it for payment.

- once the bill is paid, the credits will be recycled back into the customer’s available credits.

Many businesses operate with a line of credit. B2B, or ‘trade,’ businesses often use this kind of accounting. This makes Credit Line for WooCommerce a great solution for ecommerce owners selling to customers who want a monthly account for their purchases.

How much does it cost?

$49 per year for the WooCommerce plugin.

Conclusion

These buy now, pay later solutions for WooCommerce will help you generate more revenue by increasing your average order value and your conversion rates. Offering options at the checkout makes the final purchase decision even easier for your customers. Their seamless user experience translates directly to more sales for your store.

If you want help configuring your payment gateway to accept orders with deferred payment, get in touch. An expert member of our team will be happy to help you.

Are You Looking for a WooCommerce Pay Later Expert Who Can Help Take Your Ecommerce Site to the Next Level?

Call 919-336-1790 or click here to schedule a consultation with one of our web design experts.